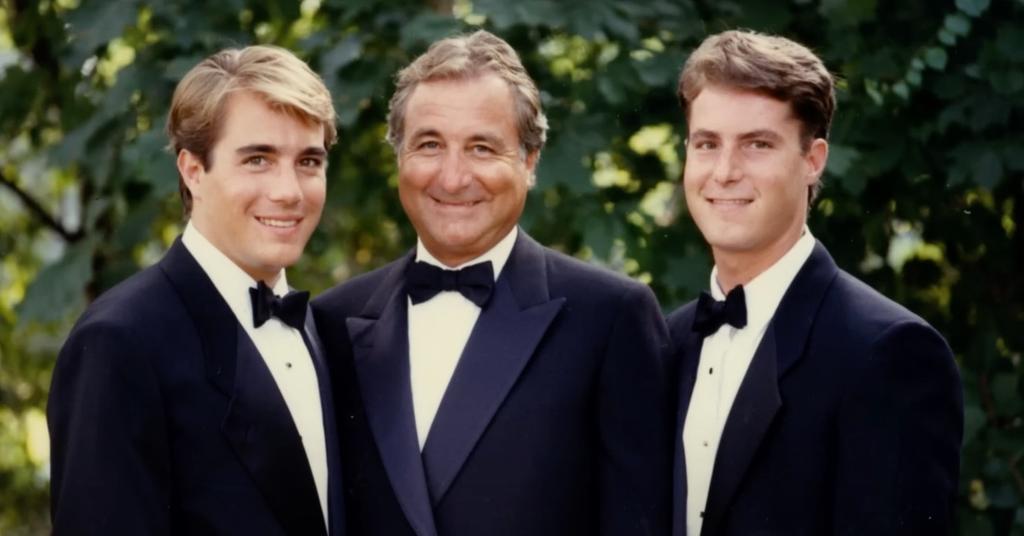

Who Was Andrew Madoff? The Madoff Scandal's Dark Side Exposed

Who bears the burden when a family legacy turns to infamy? The name Madoff is synonymous with financial ruin, but beyond Bernie, a figure emerges his son, Andrew Madoff, forever entangled in the wreckage of the largest Ponzi scheme in history.

Andrew Madoff, an American former financial advisor, is inextricably linked to one of the most staggering financial frauds of our time. As the son of Bernie Madoff, the architect of the colossal Ponzi scheme, Andrew's life and career were forever tainted by his father's actions. He worked within Bernard L. Madoff Investment Securities, the very engine of the fraud, and ultimately faced severe consequences for his involvement, including a 10-year prison sentence. His release in 2020 marked a new chapter, but the shadow of his past undoubtedly lingers.

| Name | Andrew Madoff |

|---|---|

| Born | 1966 |

| Died | September 3, 2014 (aged 48; mantle cell lymphoma) |

| Occupation | Financial advisor |

| Known for | Role in Madoff Ponzi scheme |

| Conviction | Conspiracy to commit fraud, securities fraud (though he maintained his innocence regarding direct knowledge of the Ponzi scheme) |

| Sentence | 10 years in prison (though he died before completing the sentence) |

| Spouse(s) | Deborah Alpern (m. ??; div.)Anne Madoff |

| Children | 6 |

| Parents | Bernie Madoff (father)Sheila Madoff (mother) |

| Reference | Wikipedia - Andrew Madoff |

The narrative of Andrew Madoff serves as a stark reminder of the pervasiveness of white-collar crime and underscores the vital importance of ethical conduct within the financial landscape. His complicity, however direct or indirect, in his father's deceitful scheme resulted in billions of dollars of losses for countless investors, irrevocably shaking confidence in the integrity of the financial apparatus. The Madoff saga transcends a mere financial crime; it is a profound betrayal of trust, leaving an indelible scar on the financial community and beyond.

- Evangeline Lilly Young From Lost To Role Model Fun Facts

- Vegasnzcom Your Guide To New Zealands Top Online Casino

Andrew Madoff is, fundamentally, defined by his lineage. Being the son of Bernie Madoff casts a long, inescapable shadow, providing a critical lens through which to understand his actions and the consequences he ultimately faced. His proximity to the epicenter of the fraud, the intimate access he had to his father's business dealings, all contribute to the complexity of his story. It's a narrative fraught with questions of culpability, moral responsibility, and the enduring power of family ties, even in the face of unimaginable wrongdoing.

The shadow cast by Bernie Madoff's crimes extended far beyond the financial realm, deeply impacting his own family. For Andrew Madoff, this meant living under the constant scrutiny of public opinion, grappling with the knowledge of his father's deception, and ultimately facing legal repercussions. His intimate connection to the architect of the fraud meant that he couldn't escape the narrative, regardless of the extent of his personal involvement.

The argument can be made that, by virtue of his position and access, Andrew Madoff possessed a unique understanding of his father's activities. The extent to which he comprehended the intricacies of the Ponzi scheme remains a subject of intense debate, but the fact remains that he occupied a privileged vantage point within Bernard L. Madoff Investment Securities.

- Decoding The Surviving Princesss Laughter Untold Stories Revealed

- Breaking The Truth About Lydia Curanajs Age Revealed

The phrase "Son of Bernie Madoff" isn't merely a descriptor; it's a label laden with significance. It's a stark reminder of the ethical obligations that exist within the financial world, and a sobering lesson about the potential ramifications of even indirect association with criminal activity. The Madoff name became synonymous with betrayal and financial devastation, a brand of shame that impacted every member of the family.

Andrew Madoff's professional life revolved around the world of finance. As a financial advisor at Bernard L. Madoff Investment Securities, he was entrusted with the responsibility of guiding clients and managing their financial portfolios. This role placed him in a position of trust, a role that would later be scrutinized in light of his father's fraudulent activities.

Holding the title of financial advisor meant that Andrew Madoff was expected to uphold the highest standards of integrity and prioritize the best interests of his clients. He was responsible for offering sound financial advice, managing investments prudently, and ensuring transparency in all dealings. However, his involvement, alleged or proven, in his father's Ponzi scheme cast a dark shadow over his professional responsibilities.

It is argued that Andrew Madoff utilized his position as a financial advisor to solicit new investments for his father's scheme, potentially leveraging the trust placed in him by clients to further the fraudulent enterprise. He is said to have participated in managing the flow of funds within the scheme and played a role in generating deceptive account statements, a crucial element in maintaining the illusion of legitimacy.

The link between the title "financial advisor" and the name "Andrew Madoff" serves as a cautionary narrative, highlighting the critical importance of ethical conduct in the financial industry. This case underscores the potential repercussions of engaging in illegal or unethical practices, not only for the individuals involved but also for the broader financial system.

Financial advisors operate under a fundamental obligation to act in the best interests of their clients. They must be honest, transparent, and diligent in their dealings, avoiding any actions that could compromise their clients' financial well-being. The Madoff scandal, with Andrew Madoff at its periphery, serves as a potent reminder of the potential consequences when these ethical principles are disregarded.

The Andrew Madoff saga underscores the critical need for investors to exercise caution and conduct thorough due diligence when selecting a financial advisor. Investors should prioritize advisors with established reputations, verifiable track records, and a commitment to transparency and ethical conduct. The Madoff case serves as a stark reminder that even seemingly reputable firms can harbor hidden risks.

Andrew Madoff's involvement in his father's Ponzi scheme was undeniably significant, contributing to the perpetuation and expansion of the fraud. He is said to have participated in attracting new investors, overseeing the movement of funds, and creating falsified documentation, actions that played a crucial role in maintaining the illusion of a legitimate investment operation.

By allegedly recruiting new investors, Andrew Madoff is said to have directly contributed to the influx of capital that sustained the Ponzi scheme. The new funds acquired from unsuspecting investors were utilized to pay off existing investors, perpetuating the cycle of fraud and enabling the scheme to continue undetected for an extended period.

The accusations that Andrew Madoff helped manage the funds funneled into the scheme and created fraudulent account statements indicate a deeper level of involvement in the day-to-day operations of the fraudulent enterprise. These actions, if proven, demonstrate a deliberate effort to conceal the true nature of the investment operation and deceive investors into believing their investments were generating legitimate returns.

The correlation between Andrew Madoff and his role in the Ponzi scheme highlights the critical importance of ethical conduct within the financial sector. It also serves as a somber narrative about the potential risks associated with white-collar crime. Andrew Madoff's legacy will forever be tied to the unraveling of one of the most infamous financial scandals in history.

The 10-year prison sentence handed down to Andrew Madoff for his role in his father's Ponzi scheme carried significant weight, reflecting the severity of his offenses and the extensive harm inflicted upon investors. This sentence served as a tangible consequence for his actions and sent a clear message about the justice system's stance on white-collar crime.

- Length of sentence

Andrew Madoff's decade-long prison term was noteworthy, representing one of the most substantial sentences ever imposed for a white-collar crime offense. The duration of his sentence mirrored the magnitude of his transgressions and the far-reaching devastation caused to investors who entrusted their savings to the Madoff enterprise.

- Deterrence

The severity of Andrew Madoff's sentence functioned as a deterrent, sending a strong signal to potential wrongdoers who might contemplate engaging in similar fraudulent activities. By imposing a significant penalty, the court aimed to discourage future instances of white-collar crime and underscore the potential consequences for such actions.

- Justice

Andrew Madoff's sentence brought a sense of closure and justice to the numerous victims of the Madoff Ponzi scheme. Many of these individuals experienced devastating financial losses, depleting their life savings and undermining their financial security. The sentence ensured that Andrew Madoff was held accountable for his role in the scheme and offered a measure of retribution for the harm he inflicted.

- Accountability

Andrew Madoff's sentence highlighted the significance of holding white-collar criminals accountable for their misdeeds. All too often, individuals involved in financial crimes evade punishment or receive lenient sentences. Andrew Madoff's case demonstrated that even those with wealth and privilege would be subject to legal repercussions for their participation in fraudulent schemes.

The relationship between "10-year prison sentence" and "Andrew Madoff" serves as a solemn lesson on the paramount importance of ethical conduct within the financial industry. It is also a cautionary tale about the serious consequences that can arise from engaging in white-collar criminal activity. Andrew Madoff's story underscores the risks associated with financial misdeeds and should serve as a cautionary guide for professionals and investors alike.

Andrew Madoff's release from prison in 2020, after serving his 10-year sentence for his part in his father's massive Ponzi scheme, represented a pivotal moment. His release marked the closing of a long and arduous chapter for the countless victims of the Madoff fraud, who had endured years of financial hardship and emotional distress as a result of the scheme.

Andrew Madoff's release from prison stirred significant debate about the fairness of the justice system and how white-collar criminals are treated. Some argued that his sentence was too lenient, advocating for a longer prison term to reflect the magnitude of his offenses. Others contended that his release indicated the justice system had functioned as intended and that he had fulfilled his obligation to society.

The association between "Released from prison in 2020" and "Andrew Madoff" is a poignant reminder of the necessity for ethical behavior within the financial sector. It also provides a cautionary narrative about the perils of white-collar crime. His release did not erase the memory of the Madoff scandal and it's impacts on the individuals.

This section is dedicated to addressing frequently asked questions concerning Andrew Madoff and his involvement in the Madoff Ponzi scheme, providing clarity and context to his role in this infamous financial fraud.

Question 1: What specific tasks did Andrew Madoff undertake in the Madoff Ponzi scheme?

Andrew Madoff had a consequential role in his father's fraudulent Ponzi scheme. It has been claimed he was responsible for the important task of recruiting new investors. Also, he was responsible for managing the money that was invested in the scheme. Lastly, another task that was assigned to him was helping create false account statements that were delivered to investors.

Question 2: What factors contributed to Andrew Madoff receiving a 10-year prison sentence?

Andrew Madoff's sentence of 10 years in prison was the outcome of his actions tied to his fathers Ponzi scheme. The sentence given to him reflected the amount of damage and how severe his crimes were to the investors who have been impacted by the crimes.

Question 3: In what year did Andrew Madoff complete his prison sentence and gain release?

Andrew Madoff was released in 2020 after serving the 10 year sentence due to his involvement in his fathers Ponzi scheme.

Question 4: Following his release from prison, what activities has Andrew Madoff engaged in?

Andrew Madoff has tried to keep his life private since his release from prison. He has not made statements to the public and has not given out any interviews.

Question 5: From the Andrew Madoff case, what salient insights can be extracted?

The lesson that is provided from the Andrew Madoff case, is that it is crucial to behave ethically in the financial industry. As a result of this lesson, there is also the cautionary tale of the harm that can result from white-collar crime.

Question 6: What strategies can be implemented to prevent the reoccurrence of a Madoff-like scandal?

There are many ways to try and prevent another Madoff-like scandal from happening. One way is to increase regulations on the financial industry. Also, increasing investor education, and make white-collar criminals accountable for their crimes.

- Nate Kane The Untold Story Of Batmans Son Dc Comics

- Garth Lawless The Life And Music Of A Metal Icon

Bernard Madoff's Son Andrew Dies After Long Battle With Cancer Newsweek

Andrew Madoff, Son Of Disgraced Financier Bernard Madoff, Dies At 48

Who Were Bernie Madoff's Sons, Mark and Andrew Madoff?