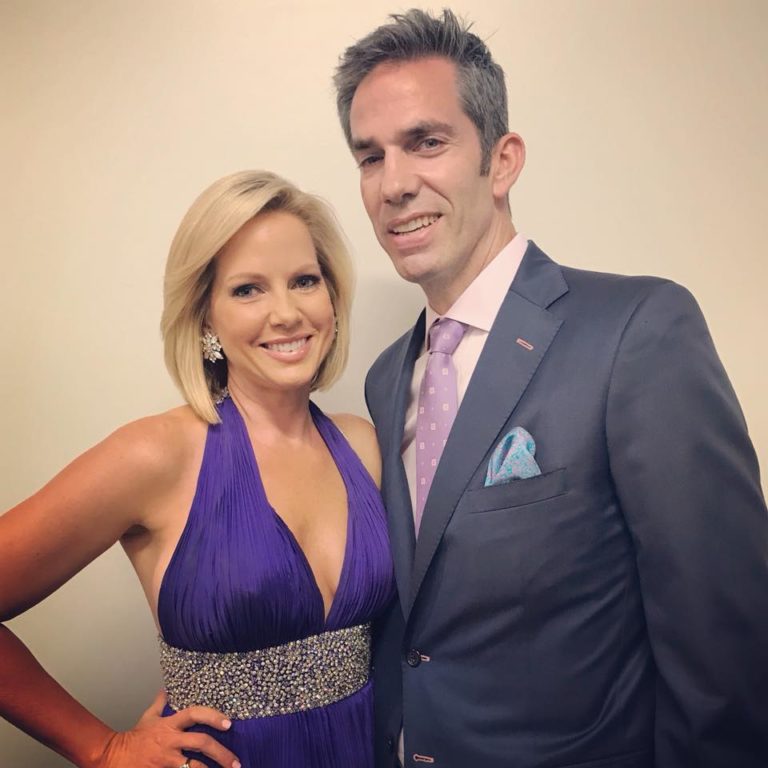

Who Is Sheldon Bream? What Does Shannon Bream's Husband Do? A Look Inside

Ever wondered how some companies explode onto the scene, seemingly out of nowhere? The answer often lies with individuals like Sheldon Bream, who strategically invest in and nurture promising ventures.

Sheldon Bream stands as a significant figure in the financial world, though he often remains outside the spotlight focused on his wife, Shannon Bream, the well-known Fox News anchor. But make no mistake, Sheldon Bream has carved out an impressive career of his own. For over two decades, he has been immersed in the high-stakes realm of venture capital and private equity, demonstrating a keen eye for identifying and cultivating burgeoning businesses. His expertise lies in channeling investment into companies with the potential for significant expansion and profitability. Currently, Sheldon Bream holds the position of managing director at New Enterprise Associates (NEA), a prominent venture capital firm, where he helps guide the firm's investment strategies and portfolio management. His journey to this position includes a solid academic foundation from the University of Virginia and the Harvard Business School, which equipped him with the skills and knowledge necessary to navigate the complexities of the financial landscape. His career exemplifies a dedication to fostering innovation and growth within the business sector.

| Name | Sheldon Bream |

|---|---|

| Occupation | Venture capitalist and private equity investor |

| Education | University of Virginia, Harvard Business School |

| Company | New Enterprise Associates |

| Title | Managing director |

| Years Married | Since 1993 (approximately 31 years) |

| Family | Married to Shannon Bream, three children |

| Known For | Husband of Shannon Bream, successful career in venture capital |

| Reference | New Enterprise Associates Official Website |

Sheldon Bream's contributions extend beyond the walls of academic institutions or corporate offices. Since 1993, he has been married to Shannon Bream, and together they have built a family with three children, balancing professional success with personal commitments. While Shannon Bream has garnered considerable public attention as a Fox News anchor and chief legal correspondent, as well as through her authorship of "The Mothers and Daughters of the Bible Speak: Lessons on Faith from the Women of the Bible," Sheldon Bream's work remains largely behind the scenes, supporting the growth of innovative companies and driving economic development. His dedication to his career and family paints a picture of a man committed to both professional excellence and personal fulfillment.

- All About Vera Farmigas Husband Renn Hawkey Facts

- Breaking Did Briana And Zach Break Up The Truth Finally

Shannon Bream's husband, Sheldon Bream, is a venture capitalist and private equity investor. He has dedicated over 20 years to the venture capital and private equity sphere, currently serving as a managing director at New Enterprise Associates. This position underscores his expertise in guiding investment strategies and overseeing the firm's diverse portfolio.

- Investor

- Venture capitalist

- Private equity

- New Enterprise Associates

- Managing director

Sheldon Bream's involvement in venture capital and private equity has been instrumental in the expansion and success of numerous businesses. His demonstrated ability to identify and support early-stage companies has led to considerable achievements and significant growth within the organizations he has invested in. This success reflects not only his financial acumen but also his strategic insight and commitment to fostering innovation and development.

Shannon Bream, apart from her role as a news anchor and legal correspondent, is also an accomplished author, recognized for her book "The Mothers and Daughters of the Bible Speak: Lessons on Faith from the Women of the Bible." Her career stands in parallel to her husband's, showcasing their respective accomplishments in diverse fields.

- Laararose Onlyfans 2024 Is It Worth It Exclusive Content

- Discover Why Li Xian Yang Zi Are Cultural Icons Explained

An investor, at its core, allocates capital with the expectation of a return, and Sheldon Bream embodies this principle through his engagement in venture capital and private equity. He channels funds into burgeoning enterprises exhibiting high-growth potential, playing a pivotal role in their trajectory.

- Venture capitalist

A venture capitalist specializes in providing financial support to early-stage companies that possess the capacity for significant growth. These investments are often directed toward companies that have yet to achieve profitability but show promising prospects for future success, making it a high-risk, high-reward endeavor.

- Private equity

Private equity involves investments in companies that are not publicly traded. These investments are typically targeted toward established companies with a strong performance history, aiming to further enhance their profitability and market position.

- New Enterprise Associates

New Enterprise Associates is a prominent venture capital firm focusing on technology companies in their early stages. The firm's portfolio includes some of the world's most successful technology giants, demonstrating its capacity to identify and nurture companies with disruptive potential.

- Managing director

A managing director holds a senior leadership position within a venture capital firm. Their responsibilities encompass making key investment decisions, managing the firm's investment portfolio, and guiding the overall strategic direction of the firm.

Sheldon Bream's work as an investor has been pivotal in providing the necessary capital for the growth and development of numerous successful businesses. His aptitude for recognizing and supporting early-stage companies has led to significant accomplishments in the organizations he has invested in.

Venture capitalists, such as Sheldon Bream, are investors who specialize in providing funding to early-stage companies that demonstrate high growth potential. They commonly invest in ventures that may not yet be profitable but have the capacity to achieve significant financial success in the future. Sheldon Bream's extensive career of over 20 years in this field is distinguished by his current role as a managing director at New Enterprise Associates.

- Role

Venture capitalists are critical to economic growth. They supply capital to businesses that are deemed too risky by traditional lending institutions, which allows these companies to innovate, create employment opportunities, and stimulate overall economic advancement.

- Examples

Many of the world's most recognizable companies, including Google, Amazon, and Facebook, received initial funding from venture capitalists. These investments led to the creation of millions of jobs and the generation of trillions of dollars in revenue, highlighting the significant impact of venture capital.

- Implications

Sheldon Bream's work as a venture capitalist has directly contributed to the funding and growth of numerous successful enterprises. His established history of investing in and supporting early-stage companies underscores his commitment to fostering innovation and economic development.

Venture capitalists play a pivotal role in the broader landscape of venture capital and private equity, providing essential funding to early-stage companies with significant growth potential. This financial backing allows these companies to develop innovative products and services, generate employment opportunities, and drive overall economic expansion.

Private equity represents a form of investment directed toward companies that are not listed on public stock exchanges. Private equity investors typically target companies with established track records and strong profitability, aiming to further enhance their value and market position. Sheldon Bream's dual role as both a venture capitalist and a private equity investor reflects his comprehensive understanding of the investment landscape, further demonstrated by his leadership position at New Enterprise Associates.

- Definition

Private equity is an investment strategy focused on acquiring ownership stakes in companies not available on public markets. Investors in private equity cannot easily liquidate their positions through stock market sales and must typically wait for the company to either go public or be acquired by another entity.

- Structure

Private equity funds are commonly organized as limited partnerships, with investors acting as limited partners and the fund manager as the general partner. The general partner assumes responsibility for managing the fund and making strategic investment decisions.

- Fees

Private equity funds often impose substantial fees, including management fees, performance-based fees, and various operational expenses. These fees can vary considerably, influenced by the fund's size, investment strategy, and overall performance.

- Risks

Investing in private equity carries inherent risks, primarily due to the illiquidity of the investments and the uncertainty of generating positive returns. Despite these risks, private equity can offer the potential for significant returns, attracting investors seeking higher yields.

Sheldon Bream's involvement in private equity has been instrumental in facilitating the expansion and enhancement of numerous established businesses. His ability to identify companies with strong financial performance has contributed to the success of these ventures, highlighting his expertise in the private equity sector.

New Enterprise Associates (NEA) functions as a venture capital firm that dedicates its resources to investing in technology companies during their formative stages. The firm's investment history boasts successful collaborations with prominent entities such as Google, Amazon, and Facebook. Sheldon Bream, in his capacity as managing director, plays a crucial role in shaping the strategic direction of NEA's investments.

- Investment focus

NEA's investment strategy centers on identifying and supporting technology companies with the potential to become global leaders. The firm's focus encompasses diverse fields, including artificial intelligence, cloud computing, cybersecurity, and healthcare technologies.

- Investment strategy

NEA adopts a collaborative approach to investing, with its partners actively engaging with portfolio companies to refine business strategies, attract top-tier talent, and facilitate entry into new markets, providing comprehensive support for growth.

- Track record

NEA has established a strong track record of identifying and nurturing successful companies, generating substantial revenue and creating numerous employment opportunities, demonstrating its effectiveness in the venture capital arena.

- Impact

NEA's investments have had a profound influence on the technology landscape and the global economy, driving innovation and shaping the way we live and work through the development of cutting-edge technologies.

Sheldon Bream's contributions to NEA have been critical in providing the financial foundation and strategic guidance necessary for the success of various technology companies. His ability to identify and support early-stage ventures has been instrumental in driving innovation and fostering growth within the technology sector.

A managing director at a venture capital firm assumes a leadership role in making investment decisions and managing the firm's investment portfolio, contributing significantly to the firm's strategic direction and overall success. Sheldon Bream's position as a managing director at New Enterprise Associates underscores his expertise and influence in the venture capital industry.

- Role

Managing directors play a crucial role in the venture capital industry, making strategic investment decisions that can have far-reaching implications for the success of their firms and the financial outcomes for their investors.

- Responsibilities

The responsibilities of a managing director are multifaceted, encompassing:

- Identifying and assessing potential investment opportunities

- Making informed investment decisions

- Overseeing and managing the firm's investment portfolio

- Engaging with and providing guidance to the firm's investors

- Qualifications

Managing directors typically possess extensive educational backgrounds in business and finance, along with a comprehensive understanding of the venture capital industry.

- Compensation

Managing directors are typically compensated through a combination of salary, bonuses, and carried interest, with carried interest representing a share of the profits generated by the firm's investments.

Sheldon Bream's work as a managing director has been vital in funding and expanding numerous successful businesses. His expertise in identifying and supporting early-stage companies has facilitated their growth and contributed to their achievements in the competitive market.

This section is dedicated to answering common queries regarding Sheldon Bream and his professional endeavors.

Question 1: What is Sheldon Bream's primary profession?

Answer: Sheldon Bream is primarily involved in venture capital and private equity investments.

Question 2: Can you explain the concept of venture capital?

Answer: Venture capital is a type of investment where capital is provided to early-stage companies that exhibit substantial potential for growth and expansion.

Question 3: What does private equity entail?

Answer: Private equity involves investing in companies that are not publicly listed on stock exchanges.

Question 4: What is the role of New Enterprise Associates?

Answer: New Enterprise Associates is a venture capital firm specializing in investments in early-stage technology companies.

Question 5: What are the responsibilities of a managing director?

Answer: A managing director is a senior executive in a venture capital firm responsible for making investment decisions and overseeing the firm's portfolio.

Question 6: What is Sheldon Bream's role at New Enterprise Associates?

Answer: Sheldon Bream holds the position of managing director at New Enterprise Associates, guiding investment strategies and portfolio management.

Sheldon Bream is a distinguished figure in the world of venture capital and private equity, consistently demonstrating a knack for identifying and nurturing promising early-stage companies, contributing significantly to their success.

To gain deeper insights into the life and career of Shannon Bream, you can explore the details available on her Wikipedia page: [link to Shannon Bream's Wikipedia page]

- Laararose Onlyfans 2024 Is It Worth It Exclusive Content

- Exploring The Laughter Of The Surviving Princess Manga A Deep Dive

Sheldon Bream Job What Does Shannon Bream's Husband Do For A Living?

What Disease Does Shannon Bream Have? Husband's Cancer and Health

Sheldon Bream, Life Details about Shannon Bream's Husband